Seems I spend much of my life belatedly learning about things I should have known all along or heard about much earlier. Here’s the latest example. It comes from an article in last week’s print edition of The Economist, entitled Carbon Copy. The article is short, and it’s reprinted here in its entirety:

Some firms are preparing for a carbon price that would make a big difference

THE markets for CO2 have had about as good a year as Obamacare. Europe’s emissions-trading system (ETS), the world’s largest carbon market, collapsed in April. Australia’s new government is killing off that country’s fledgling market. Yet companies are blithe. “Internal carbon prices”, the price of a tonne of CO2 used for planning purposes within firms, are becoming an increasingly common business tool. Perhaps firms know something that markets and politicians do not.

A study by CDP, a research group, asked large firms based or operating in America what tools they had for managing risk; 29 said they used an internal carbon price. Anecdotally, more apply such a price but did not mention it as a risk-mitigation measure. This is the first economy-wide picture of how far internal carbon pricing has gone and what it is used for.

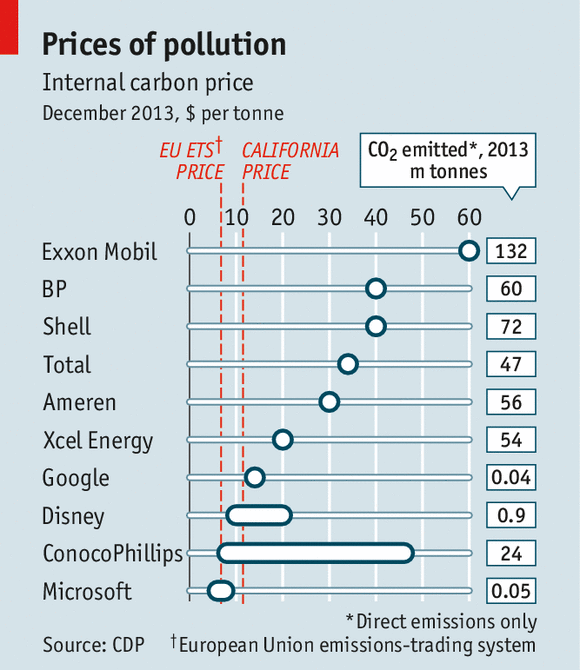

The prices range from $6-7 a tonne of carbon dioxide at Microsoft to $60 a tonne at Exxon Mobil. The span is not surprising, since companies use carbon prices for different purposes. As a rule, those whose assets have a long productive life and which might be affected by green policies far into the future (such as oil companies) use higher prices than consumer-goods firms whose products are mainly influenced by current policies (see chart).

For many companies the aim is to prepare themselves for future environmental legislation. AEP, a power supplier, says it uses the system because “it assumes a price of carbon…will begin in the US by roughly 2020.” Delta Air Lines says it uses a price for evaluating flights to Europe “in anticipation of compliance with EU ETS.”

This is not the only reason. Many firms use an internal carbon price to calculate the value of future projects and to guide investment decisions. ConocoPhillips, an oil firm, requires that capital projects worth over $75m calculate the cost of emissions based on a price of between $8 and $46 a tonne, depending on the life of the project. The forecast value of a new oilfield would be: estimated output multiplied by the estimated future oil price minus development costs and carbon emissions.

Shell, another oil company, applies a carbon price—$40 a tonne—to some current operations, not only future ones. The idea is to identify “tall poppies” (units with disproportionate pollution). The price implies that existing projects could spend up to $40 to reduce a tonne of CO2 (through things like energy efficiency). Angus Gillespie, Shell’s vice-president for CO2, says “we apply the carbon price as much to spur mitigation as to quantify risks.”

Disney, a media conglomerate, goes further still. It invests in schemes to offset or reduce carbon emissions and charges the cost of these to business units in proportion to how much they contribute to the company’s overall emissions. In effect, this works like an internal carbon tax.

Perhaps the most intriguing thing about the prices, though, is how high some of them are. The market price of carbon is €4.90 ($6.70) per tonne of CO2 in the EU, $11.50 in California. Big oil companies charge $34 or more. That is closer to the “social cost of carbon”—the damage from an extra tonne of CO2—than to the market price. America’s administration recently estimated the social cost at $37 a tonne. These prices change behaviour. A huge amount of attention is paid to government action. But the sort of carbon price some companies are using for planning would, if it became a market price, have a much bigger impact than any of the policies that governments are now talking about.

This corporate carbon-pricing is only a special example of a larger takeaway: Even as top-down, command-and-control approaches to dealing with global problems – the Earth as a resource, a victim, and a threat – decline in effectiveness, a wonderful diversity of “local, place-based” approaches are taking up the slack. (The phrase “local, place-based” appears in quotes here, because the corporations aren’t local or locatable in a strictly geographical sense so much as in some kind of economic or business “space.”) Note that concerns about uniformity of pricing in the name of fairness and the tragedy of the commons appear to be misplaced. Individuals and corporations seem to be quite able to make decisions based on an internal compass as much as an external dictum. Seven billion people are not sitting idle, waiting for a handful of world leaders to make decisions for them.

Look around, and you’ll see initiatives of this sort springing up everywhere, addressing our needs for food, water and energy; our efforts to protect the environment and ecosystems; and our desire to build community resilience to hazards. Individuals and institutions are paying attention to new knowledge and understanding revealed by Earth observations, science, and services. As they make decisions and act locally, they’re in effect conducting thousands of pilot projects. As they share their failures and successes through social networking, they’re building the knowledge base needed to craft resource, environmental, and hazard risk management policies at national, and international levels. That’s why this century promises to be mankind’s best yet.

Good to remember as we put a close to the year 2013 with all its woes and look forward to an seemingly equally problematic and challenging 2014.

____________________________

These ideas are developed more thoroughly in a book about to be published by the American Meteorological Society: Living on the Real World: How Thinking and Acting Like Meteorologists Will Help Save the Planet.